ATTENTION: Anyone Ready to Fix Their Credit for Just $1 Today!

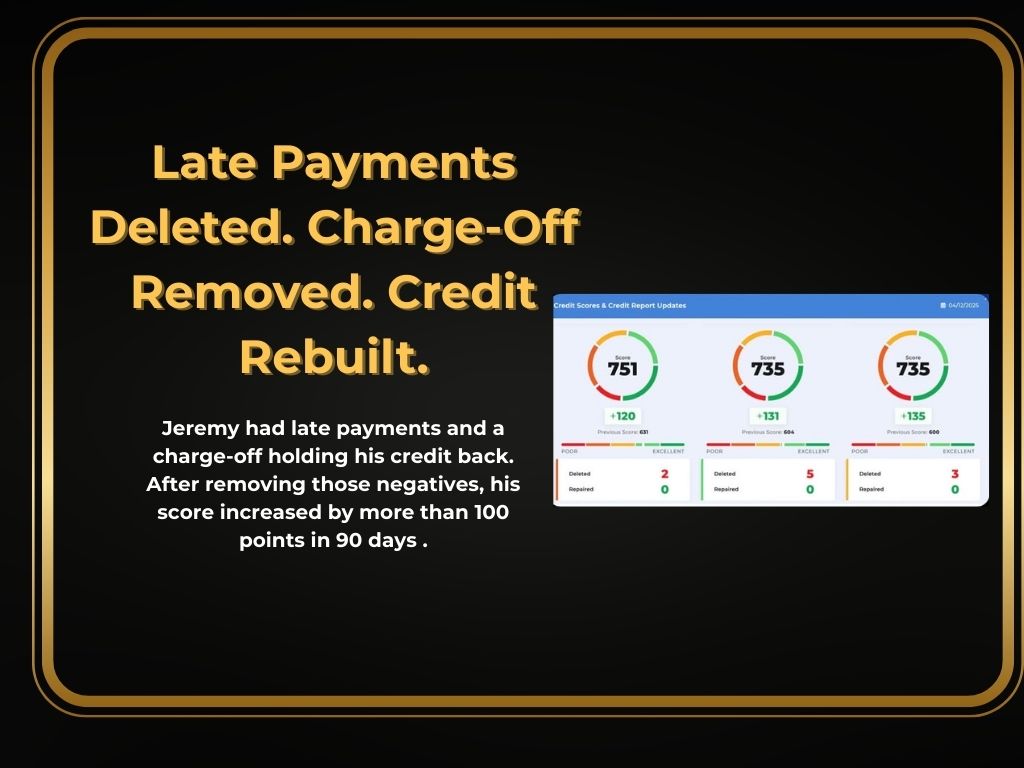

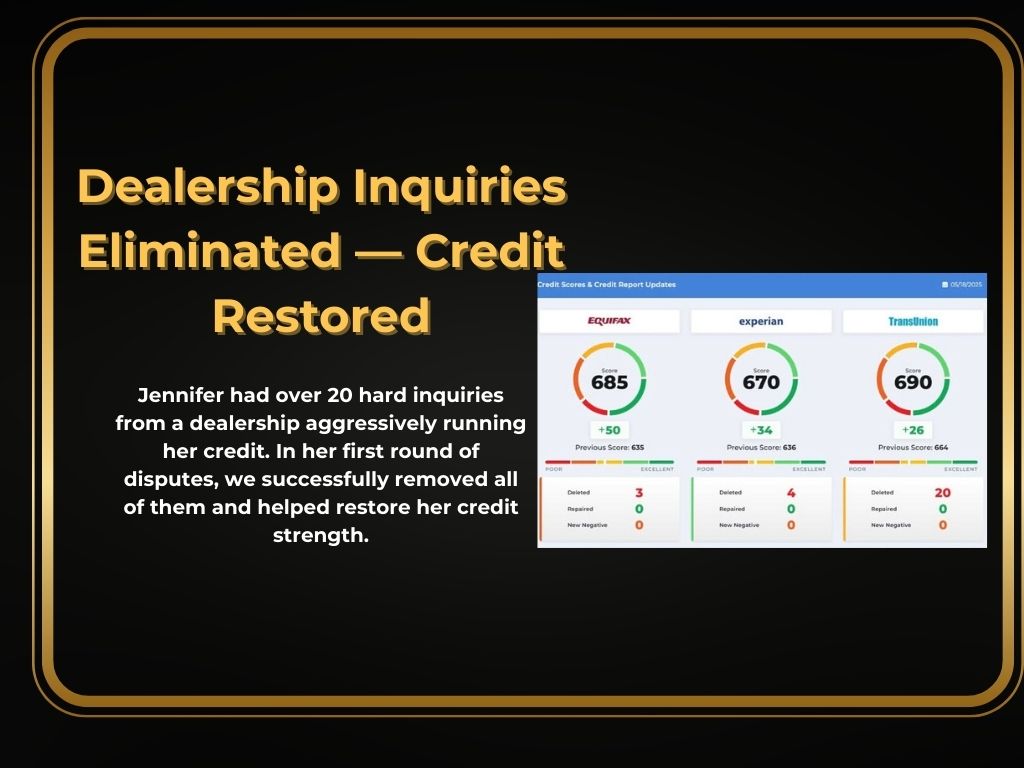

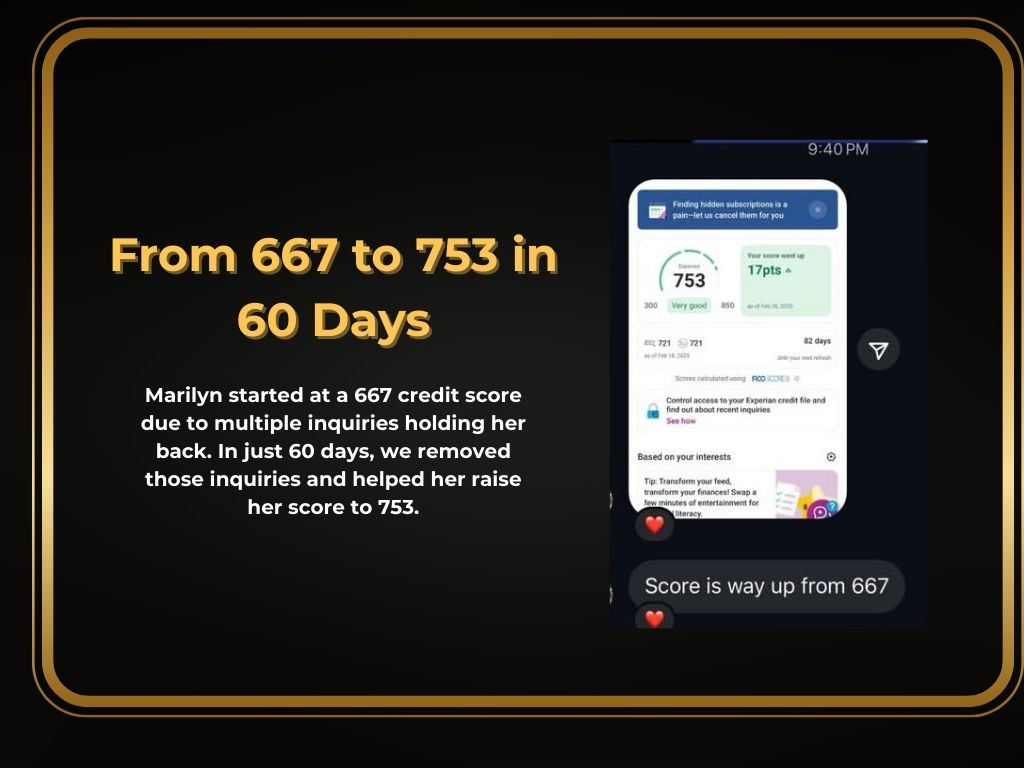

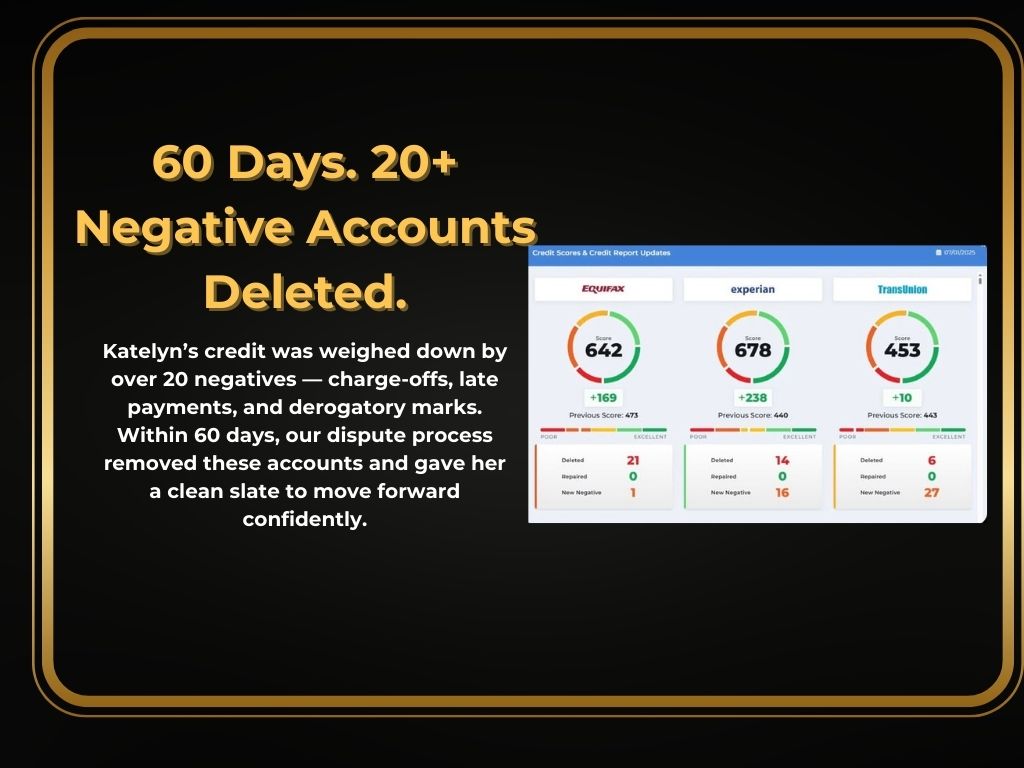

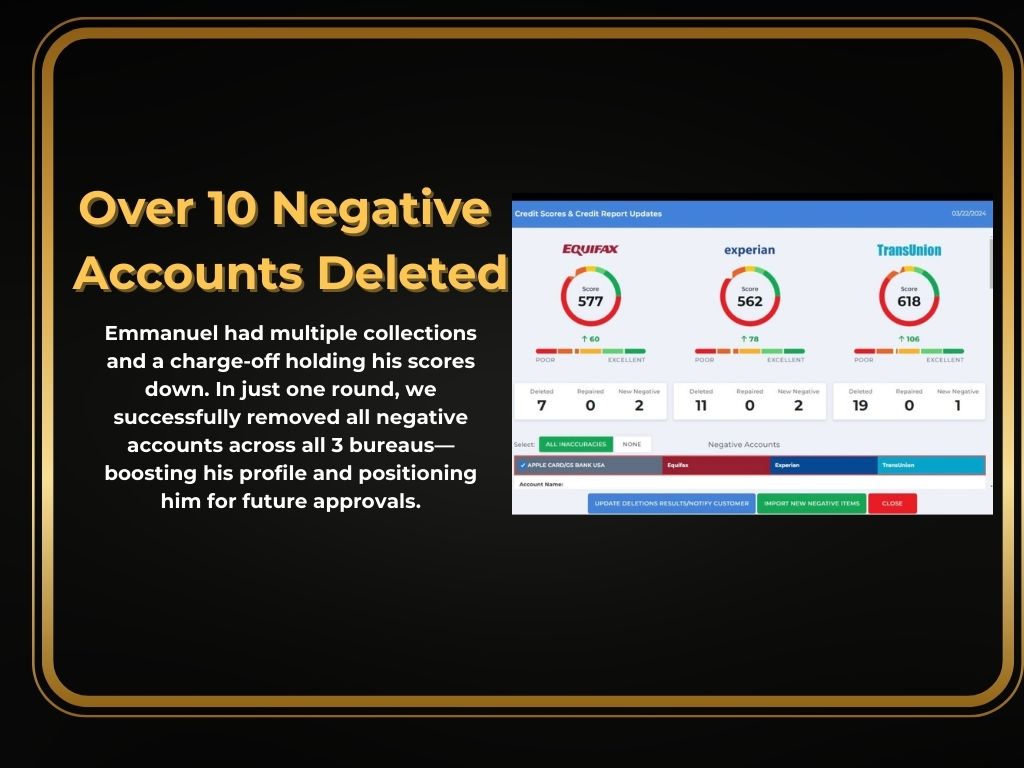

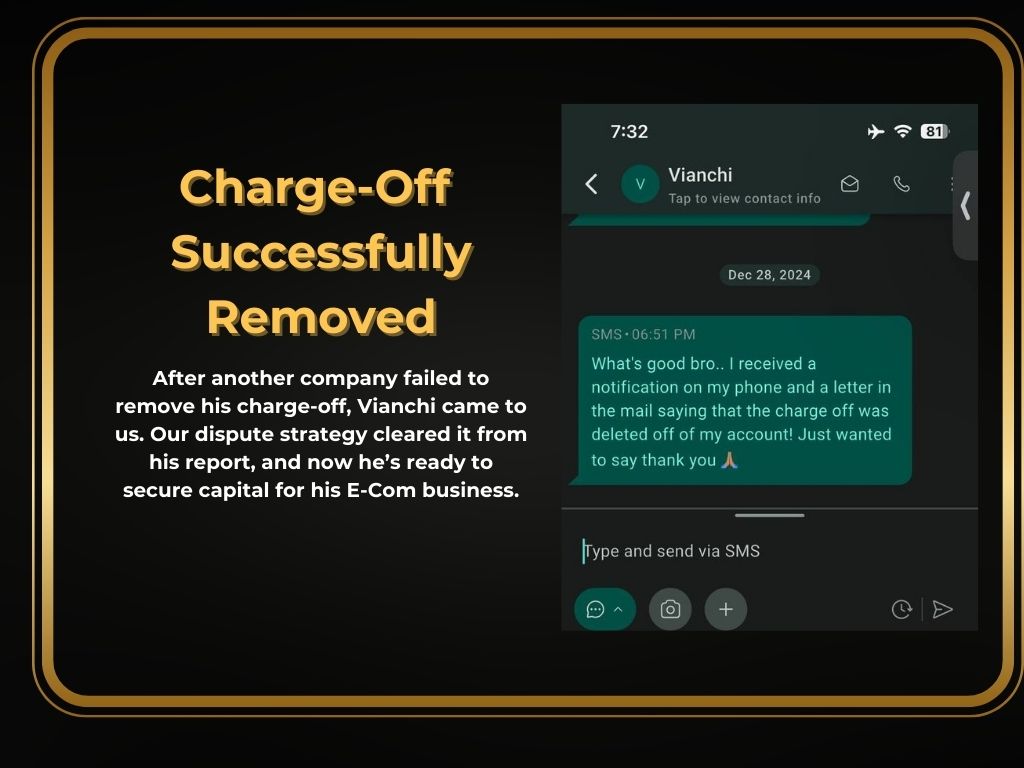

Discover How 200+ People Erased Negative Items and Rebuilt Strong Credit—Seeing Noticeable Results in as Little as 90 Days...

Whether you’re aiming for a new car, a first home, or lower interest rates, our proven process makes credit restoration simple and stress-free

Leave the past behind. Our team manages every dispute and tracks every change so you can rebuild strong credit—backed by our full money-back guarantee.

Here’s Exactly What You Get for Just $1

✅ Full 3-Bureau Credit Report for Only $1 – See everything the lenders see.

✅ Expert 1 on 1 Consultation – Customized recommendations to boost your score

✅ Pinpoint Negative Items Dragging Down Your Score – No guesswork, just facts.

✅ Custom Repair Plan—Not Cookie-Cutter Letters – Tailored disputes designed to get results fast.

How It Works?

Why Our process Works

Most credit repair fails because it relies on Generic Disputes letters and automated templates. Our approach is different.

We analyze how each account is being reported across all three credit bureaus

We dispute inaccuracies based on reporting errors, not guesses.

We adjust strategy as creditors respond - instead of sending the same letter repeatedly.

This why clients see real movement, not just "disputes sent."

Frequently asked Questions

Will this hurt my credit?

No. Reviewing your credit report and disputing inaccurate information does not lower your score. In many cases, correcting errors helps improve it over time.

Why is there a $1 charge?

The $1 covers secure access to your full 3-bureau credit report. This allows us to review your report in real time during your consultation and provide accurate guidance.

How long does it take to see results?

Every credit profile is different. Some clients see movement within the first 90 days, while others may take longer depending on the items being addressed.

Are results guaranteed?

No credit repair company can guarantee specific outcomes. However, we stand behind our process with a 180-day money-back guarantee if no measurable progress is made, provided program requirements are met.

Our focus is on disputing inaccurate or unverifiable information using a compliant, proven strategy designed to create real results.

Is this legal?

Yes. Credit restoration is legal and regulated under the Fair Credit Reporting Act (FCRA). This federal law gives consumers the right to dispute inaccurate, incomplete, or unverifiable information on their credit reports and requires credit bureaus to investigate and correct any reporting errors.

What happens after my consultation?

After your credit review, you’ll receive a clear breakdown of what’s holding your score back and the next steps available to help you move forward.